How do you deposit Bitcoin or any other cryptocurrency into your bank account?

Unfortunately, as of now, conventional banks aren’t offering any bitcoin or crypto-based checking or savings accounts.

However, there are some alternatives and if you're just thinking about converting your bitcoin into cash, there are several ways to do that as well.

In this piece, I’ll lay out a few options for your Bitcoin transactions and a number of them will work for a variety of altcoins too.

Traditional banks aren’t in the position, or mindset of accepting bitcoin or any crypto yet. But there are alternatives where you can trade bitcoin & other cryptocurrencies with a checking account that earns interest, such as digital banking platforms. There are also crypto debit cards that allow you to spend crypto on daily purchases and withdraw cash from conventional ATMs.

Digital banking platforms allow banks & other financial institutions to digitize their banking operations, so they can run on the web rather than just from a physical location.

One such platform is Juno; they offer the ability to trade over 35 cryptocurrencies from a checking account that’s FDIC insured and earns interest.

Another thing you can get is the capability to direct deposit your check from work with them in the form of crypto, and in whatever percentage you want.

They also have a crypto debit card, where you can use cryptocurrency to buy items from name-brand stores and get money from regular ATMs.

Now when it comes to cashing cryptocurrency out so it can be transferred to a bank, crypto exchanges are probably the most used method.

Take coinbase for example, you can link your bank account and then sell your bitcoin or various other cryptos there and then transfer the money to your bank account.

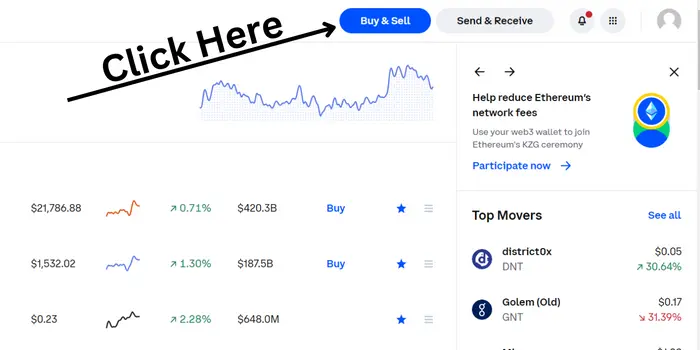

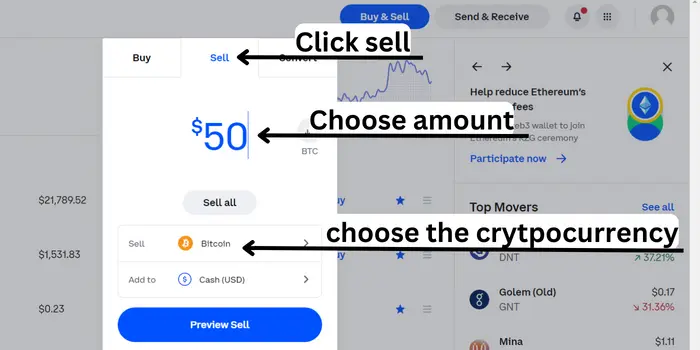

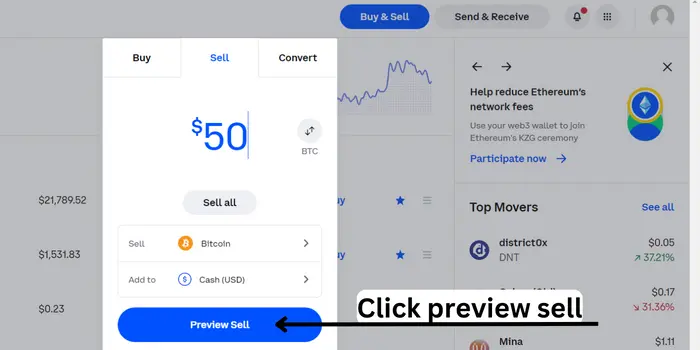

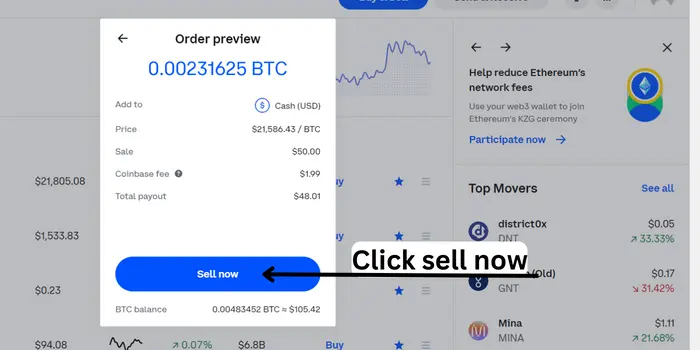

Here is a quick overview of the process along with some visual aids.

First, you click on the “Buy & Sell” button.

Then you click sell, choose the amount, and which cryptocurrency you want to sell.

After that, you click the “preview sell” button.

Then if everything is a-ok, click “sell now”.

Next, once the transaction is complete you can send the money to your bank account, it should take between 3 to 5 days.

This process is pretty similar at all legitimate exchanges.

Peer-to-Peer trading platforms are only used as a means of uniting buyers with sellers, they’re not the same as centralized cryptocurrency exchanges.

Using P2P exchanges enables people to trade cryptocurrencies without the need for a middleman or a centralized exchange.

Most of them also allow users to trade their cryptocurrencies for fiat currency as well.

So how it works is after connecting, and once the buyer & seller agree, a smart contract executes and the cryptocurrency is released to the buyer, while the money is sent to the seller.

Brokerages such as Robinhood and Interactive Brokers are another good way to sell your crypto for cash.

Surprisingly, it’s not that difficult either.

All you do is select the desired cryptocurrency and enter the amount you wish to sell if you’re not cashing out altogether.

Then go over the information in the sell order to ensure that everything is correct and if so submit the order.

After that, you can just withdraw the funds, unless you plan on leaving them in the brokerage account.

Basically, with bitcoin ATMs, you choose the crypto you want to sell since some deal with more than just bitcoin.

Next, enter the amount of bitcoin that you want to exchange.

After that, you will put in your phone number and receive a password.

The machine will then give you a QR code to scan in order to send them your bitcoin.

Lastly, you’ll just wait a few minutes for blockchain confirmation, then voila, the ATM will dispense your cash.

Master Card is gearing up to bring Bitcoin & crypto trading to everyday banks.

They’re partnering up with crypto custody providers that are licensed & regulated, to bring trading services to the clients of traditional financial institutions for select crypto assets.

Along with enhanced security, advisory services, and help with regulatory compliance for them as well.

While you may not be able to transfer bitcoin to your bank, there are other ways to cash out your crypto and get the money into your account. First, there are digital banking platforms, like Juno, where you can trade crypto from a checking account and they also offer a crypto credit card too. You can also use crypto exchanges, peer-to-peer exchanges, brokerages, & bitcoin ATMs to convert your bitcoin to cash. Finally, it looks as if Master Card is preparing to assist traditional banks & financial institutions with offering crypto trading to their clients.